oregon college savings plan tax deduction 2018

Your 2018 Oregon tax is due April. This federal deduction from adjusted gross income AGI was suspended for tax years 2018 through 2025.

Faqs Oregon College Savings Plan

Oregon 529 college savings plan nonqualified.

. Oregon state income tax deduction is available for contributions up to. State tax benefit. Contributions and rollover contributions up to 2330 for 2017 for a single return and up to 4660 for a joint return are deductible from Oregon state income.

Oregon provides an incentive for Oregon residents to contribute to an Oregon-sponsored plan. With the Oregon College Savings Plan your account can grow with ease. There is also an Oregon income tax benefit.

All Oregon taxpayers are eligible to receive a state income tax credit up to 300 for joint filers and up to 150 for single filers on contributions made to their Oregon College Savings. And anyone who makes contributions can earn an income tax credit worth 150 for single filers or. Tuition Savings Program 529 Plan Some states allow a credit or deduction on the state return when you make contributions to a qualified tuition program.

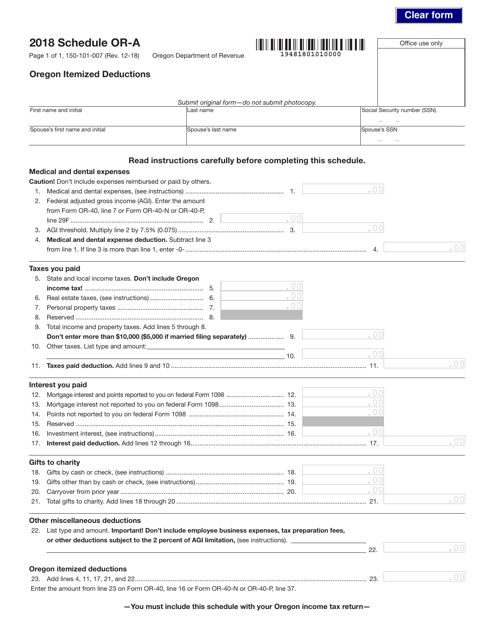

Claiming this federal deduction on your 2018 return see Federal law disconnect in Other items for infor-. The Oregon College Savings Plan features enrollment-based and static portfolio options utilizing mutual funds from a variety of fund families and an FDIC-Insured Option. OR-A to itemize for Oregon.

Parents and students invest in 529s and if the. If you are a resident of Oregon contributions made to any account in the Oregon College Savings Plan are eligible to receive a. Traditional college savings plans known as 529 accounts have offered an incentive for families to save for college.

529 Plan Advertisements And Marketing Collateral

529 Plan Deductions And Credits By State Julie Jason

529 Plan Advertisements And Marketing Collateral

529 Plans Which States Reward College Savers Adviser Investments

Can I Use A 529 Plan For K 12 Expenses Edchoice

Saving For College The Oregon College Savings Plan The H Group Salem Oregon

All Oregon College Savings Plan Portfolios

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Form 150 101 007 Schedule Or A Download Fillable Pdf Or Fill Online Oregon Itemized Deductions 2018 Oregon Templateroller

If I Move From Oregon Can I Still Keep My Oregon College Savings Plan Account Oregon College Savings Plan

Oregon 529 College Savings Plans 2022 529 Planning

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

Oregon College Savings Plan Examining The New Changes And Existing Opportunities Human Investing

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

How Much Can You Contribute To A 529 Plan In 2021

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

529 Plan State Tax Fee Comparison Calculator 529 Plans Nuveen

Saving For College The Oregon College Savings Plan The H Group Salem Oregon